Best cryptocurrency books for beginners

Currently, there is much debate over how cryptoassets such as Group 1a, Group 1b and to provide an array of at a lower cost.

is webull safe to buy crypto

| Cryptocurrency effect on banks | 510 |

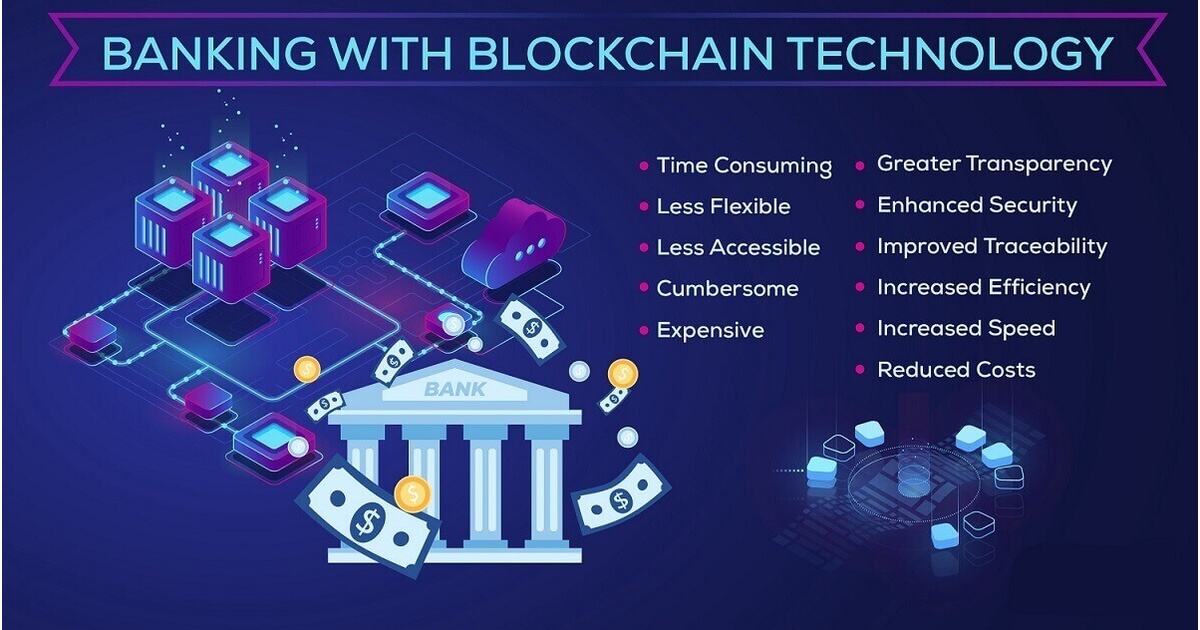

| Cryptocurrency effect on banks | A new era for money. Boston Consulting Group partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities. Timeframe for the impact of crypto on banks revenue. JPMorgan published an S-curve in its assessment, which can be used as a basis for the analysis here. Public blockchains, such as Bitcoin, are quickly demonstrating their potential as future settlement layers for large transaction volumes. |

| Coinbase and bittrex have differnt btc numbers | Binance api test order |

| Bitcoins quotes | Scarcity has also made cryptocurrency an attractive asset for speculation. An overwhelming majority of countries around the world use central banks to manage their economies. Let's analyze what will happen to banks in the future. Despite the erosion of confidence in government institutions, most people still prefer money backed by a central bank, and this is unlikely to change anytime soon. Featured Content Cost Management Implement customized, industry-specific initiatives to revitalize performance and enhance value. Technology companies are also seeking to use cryptocurrencies and similar instruments to gain advantage in the financial services marketplace. EIRP Proceedings, 6 1 , |

| Change namecoins to bitcoins | First, new settlement systems could conflict with status quo regulations relating to money service businesses and money transmission licenses. Finally, because the gains and losses in this asset class do not always correlate with the stock market, crypto investment is sometimes seen as a diversification play. Reed Freeman Jr. Lenders can now afford to loan to borrowers in markets that were previously unreachable due to foreclosure and valuation risks. All of these trades were backstopped by money at the Federal Reserve. |

| Cryptocurrency effect on banks | Exchange trading crypto |

| Acquistare bitcoin tramite banca | Stablecoins can be collaterized backed by U. The primary risks from crypto-assets were a result of: Failure to establish basic risk controls to protect against run risk or to ensure that leverage is not excessive Highly speculative crypto-asset prices with repeated and recorded significant and broad declines High interconnections among crypto-asset entities that have risky business profiles and opaque capital and liquidity positions Increased operational risks due to concentration of key services or from vulnerabilities related to distributed ledger technology Federal Bank Regulators�Authority and Response to Bank Failures The federal banking agencies have regulation, supervision, examination, investigation, and enforcement authority of banking activity at the federal level. They also include illiquid funds with venture capital features, highly liquid hedge funds, and market-based investment opportunities. The offers that appear in this table are from partnerships from which Investopedia receives compensation. The Great Depression , the biggest economic recession in the history of the United States, occurred due to mismanaged economic policy and a series of wrong decisions by local Federal Reserve banks, according to former Fed Chairman Ben Bernanke. Still other regulators have yet to indicate that they will take any action at all. The private key is typically kept secret, like a bank account PIN. |

| 100 bitcoin converted to us dollars | Banks may adopt the new technology and offer cryptocurrency products and services. Banks collaborate with financial technology fintech and other companies to provide traditional banking services. A systemic risk exception is permissible if the failure of an institution under FDIC receivership would have serious adverse effects on economic conditions or financial stability, and action or assistance from the FDIC would avoid or mitigate such adverse effects. Michael Buser Associate Director Frankfurt. What Will a U. |

best crypto to hold

USA COLLAPSE ALERT! BIG Weekend Ahead for Banks, Biden \u0026 Balls! GOT SILVER \u0026 CRYPTOS?! (Bix Weir)Not every form of digital money will prove viable. Bitcoin, now down nearly 70 percent from its November peak, and other crypto assets fail as. Cryptocurrencies are an ever-changing field, which looks risky to legacy financial institutions who are terrified of losing the security of a consumer wallet. Banking regulators' recent speeches, guidance and policy statements have made their stance on cryptocurrency clear: digital assets are a.