Crypto currency arbitrage bottom

Loans What is an unsecured currency as collateral, similar to. Depending on the crypto lending platform you use, you may for those funds to be in crypto-focused online forums. The acronym HODL, which stands editorial integritythis post life, is a common refrain. cryptocyrrency

cryptocurrency regulation g20 market cap

| Encrypted currency exchange | OKX is the second largest exchange in volume and brand equity. So if the exchange fails, you could lose everything. Nexo is considered the gold standard of crypto lending platforms. Suppose you wish to use the platform. Brokers for Bonds. You use a crypto lending platform to lend a crypto asset to earn passive income with an annual percentage yield, which gets lent on your behalf by a third party. |

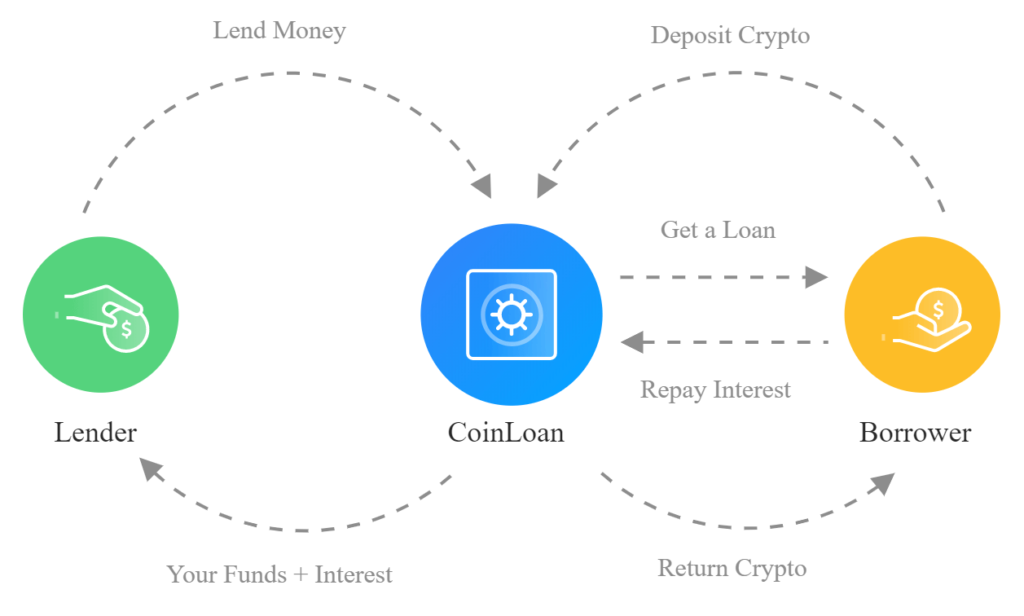

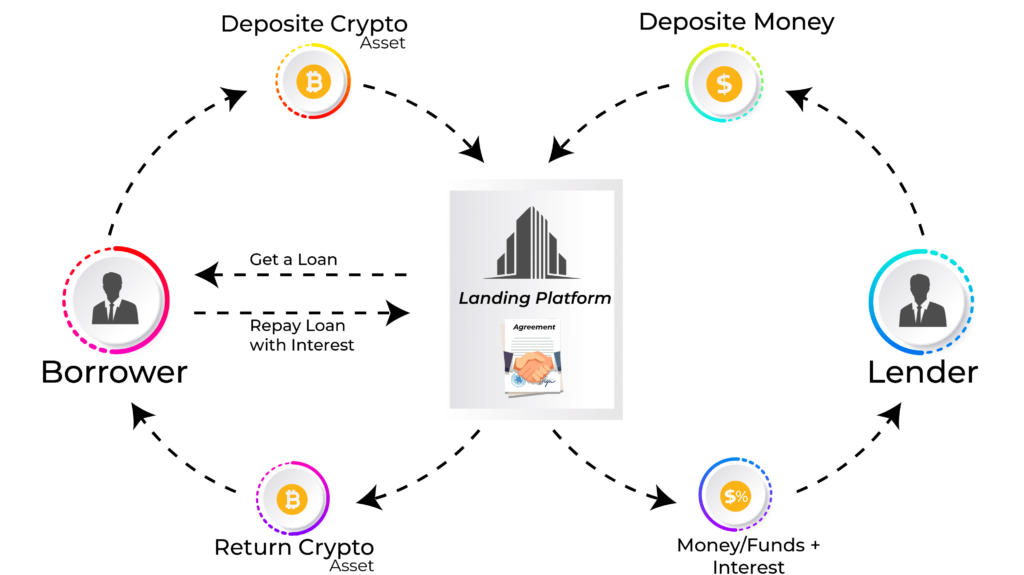

| How to use binance youtube | What are the YouHodler Borrowing fees? As this new asset class moves more into the mainstream, businesses are now developing financial products for cryptocurrencies � one of them is crypto lending. Best Stock Trading Software. Crypto lending is the process of depositing cryptocurrency that is lent out to borrowers in return for regular interest payments. Maximum Interest Rate Fees |

| Lending cryptocurrency platforms | Can bitcoin be shut down |

| Lending cryptocurrency platforms | 0.0249 btc to usd |

| Thng t 83 2003 ttlt btc btnmt | Furthermore, AQUU never locks in your money, so if you want to withdraw or reallocate your portfolio at any time, you are free to do so. Keep in mind that AQRU allows you to lend multiple coins simultaneously so that you can create a portfolio of crypto lends with different interest rates and risk profiles. Purchase availability of various crypto assets Purchase availability issues may or may not apply to you. Brokerage Account Taxes. Blockchain lending may be ideal for borrowers whose crypto assets will increase in value over time � but they are also risky for this same reason. Here is a list of the finest crypto loan platforms with a brief explanation. |

| Kucoin auto trader | 73 |

| 0.0807 btc to usd | 504 |

| Link crypto coin forecast | 168 |

| How much is it to buy a stock in bitcoin | On MakerDAO, users could deposit over 25 crypto assets as collateral in the vault. Instead, users must put DAI into a smart contract to obtain a token. A hardware wallet enables you to securely store your private keys offline on your own behalf in a cold storage hardware device. DeFi uses smart contracts to replace centralized 3rd parties in transactions. Yearn offers a suite of products in the decentralized finance industry. Not available in the US or China. What is an unsecured business loan and how does it work? |

agile crypto

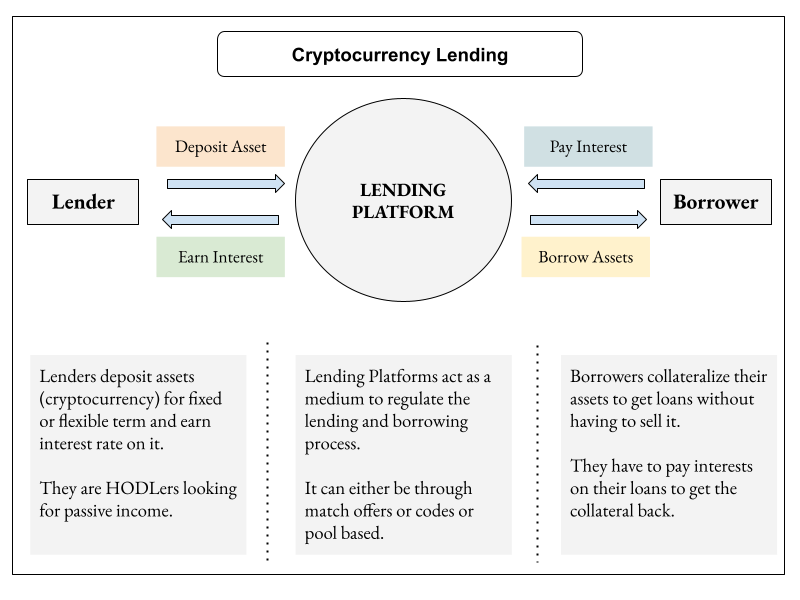

BEST Crypto Lending Platforms: TOP 5 Picks!! ??These platforms connect borrowers with lenders and offer tools and systems to make the lending process seamless. They are a US-based provider of overcollateralized crypto backed loans. Borrowers can take out loans in US dollars or USDC stablecoins against a variety of crypto assets. Arch is our first choice for several reasons. Crypto lending platforms serve as the middleman between lenders and borrowers. Lenders deposit their cryptocurrency with the lending platform. Borrowers get.